Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics provide investors with specific non-traditional metrics. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Individual shareholders may realize returns that are different to the NAV performance.

Performance data is based on the net asset value (NAV) of the ETF which may not be the same as the market price of the ETF. Performance is shown on a Net Asset Value (NAV) basis, with gross income reinvested where applicable. Share Class and Benchmark performance displayed in USD, hedged fund benchmark performance is displayed in USD. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The figures shown relate to past performance. Fund expenses, including management fees and other expenses were deducted. The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of dividends and capital gains. Depending on the exchange rates, this may have a positive or negative impact on the performance of the Fund. The currency hedging is designed to reduce, but cannot eliminate the impact of currency movements between the Base Currency and the currencies in which some or all of the underlying investments are transacted. There is a risk of default where the issuing company may not pay income or repay capital to the Fund when due. The fund invests in fixed interest securities issued by companies. Credit risk refers to the possibility that the issuer of the bond will not be able to repay the principal and make interest payments. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds.

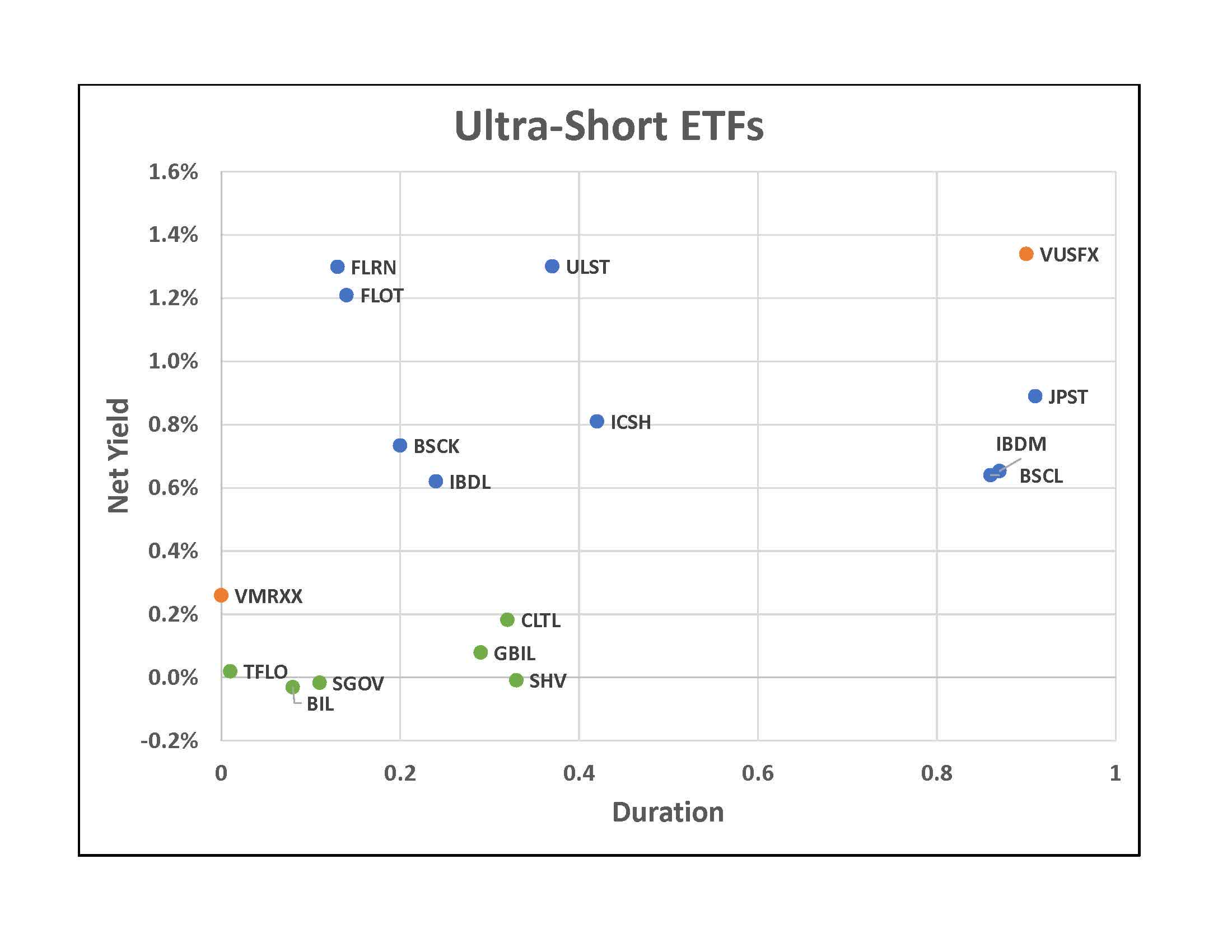

Two main risks related to fixed income investing are interest rate risk and credit risk. ETFs trade on exchanges like stocks and are bought and sold at market prices which may be different to the net asset values of the ETFs. Important Information: Important Information: The value of your investment and the income from it will vary and your initial investment amount cannot be guaranteed. Investors may not get back the amount originally invested. The value of investments and the income from them can fall as well as rise and are not guaranteed.

0 kommentar(er)

0 kommentar(er)